Do Social Security and Medicare Programs Have Enough Money?

Posted on: March 21, 2021

Botti & Morison Estate Planning Attorneys, Ltd.

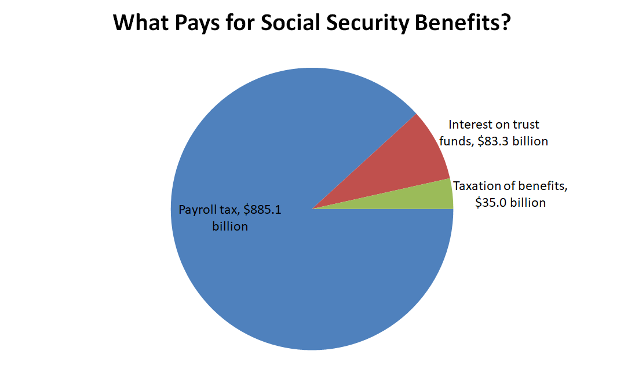

Over 10,000 baby boomers are turning 65 years old every single day according to the American Association for Retired Persons (AARP). The deluge of aging Americans and the increase in longevity in the already 65 plus population are the main reasons why the Social Security and Medicare programs are expected to have financial insolvency issues in the coming decades. Unsurprisingly, the vast majority of baby boomers agree that it is critical to preserve Social Security benefits even if it requires an increase in taxes paid into the system by working Americans. Payroll taxes by far account for the majority of monies available to pay for social security benefits.

The boomer generation is keen to preserve social security benefits as many of them are not well prepared for retirement. The financial retirement picture for nearly half of the younger boomers (ages 55 – 64) is bleak with reportedly no retirement savings at all. The US government is also unprepared to sustain full benefit payments. By the Social Security Administration’s admission in 2034, the program will run out of reserves at which time benefits would have to be reduced by 25% unless the government can fix the programs long-term funding shortfall.

This same group of unprepared boomers also appears to have uncertainty as to how much of their income health care costs are projected to absorb. Health View Services states “HealthView Services’ Retirement Healthcare Cost Index, which calculates the percentage of Social Security benefits required to address total lifetime retirement healthcare expenses, reveals the impact of expected healthcare costs on retirement budgets. The index shows a healthy 66-year-old couple retiring today will need 48% of their lifetime Social Security benefits to address total lifetime healthcare expenses.” Additionally, about half of baby boomers believe Medicare will cover the cost of long-term care, but that is not the case.

How federal government institutions face the challenge of covering the costs of social insurances like Social Security benefits and Medicare costs to a burgeoning boomer population will determine whether many citizens will be able to age successfully. Beyond the more significant problem of funding these social programs, the government is looking to technology to cut costs for senior care. Virtual assisted living that can help families care for older adults and smart devices appear to be some of the technological saviors for the American baby boomer population.

Joseph Coughlin, Ph.D., director of the MIT AgeLab in Cambridge, MA, and others testify before the Senate Special Committee on Aging as debate about policy and program funding for American seniors can no longer be put off. Coughlin recommends that virtual reality (VR) become a standard device among senior living communities, assisted living and nursing homes. Not only did residents engaging with VR have fun, but there is also less depression and more engagement in active conversations with other residents as a by-product of the technology.

Other technologies on display include smartphone apps with health functions, smart glasses that can help prevent accidental falls for seniors with limited eyesight, and a pen that can help people with reduced vision identify items. Using these and other tech devices can create a better aging experience and reduce the need for hospitalization for many seniors. Technology provides a net benefit for programs like Medicare that routinely pay for hospitalization costs that include injuries due to falling, reactions from incorrect prescription dosages, and other emergent care needs that can be avoided with practical technology applications.

While no one can discount the importance of funding social programs that benefit aging Americans, applications of specific technologies for seniors can reduce overall costs associated with the baby boomer generation. As the federal government begins to tackle the issues at hand for seniors, there is a lesson to be learned. Putting off Long-Term Care Estate Planning or relying on some other entity to solve retirement and health care issues is a dangerous proposition.

Please contact us today at 877-585-1885 or schedule a free consultation to discuss your legal matters.

Thanks for reading.

Christopher E. Botti, Esq., Certified Specialist in Estate Planning, Trust and Probate Law